A comprehensive analysis of the most common financial pitfalls that prevent middle-class households from building sustainable wealth

The Middle-Class Financial Paradox: Why Higher Income Doesn’t Equal Higher Wealth

Analysis of Federal Reserve data reveals a troubling trend: despite median household incomes rising 68% over the past three decades, middle-class wealth accumulation has remained stagnant. Families earning between $50,000 and $125,000 annually—the traditional middle class—often find themselves living paycheck to paycheck despite comfortable incomes.

This phenomenon, which economists term “lifestyle inflation,” represents a systematic breakdown in financial decision-making that prevents otherwise successful individuals from building long-term wealth. The following analysis examines seven critical mistakes that characterize this pattern and provides evidence-based solutions for immediate implementation.

Understanding these mistakes is crucial because, as Benjamin Graham noted in “The Intelligent Investor,” the difference between financial success and failure often lies not in earning capacity, but in spending discipline and systematic wealth-building practices.

Mistake #1: The House Payment Trap – Violating the 28% Rule

The Problem

The most significant wealth destroyer for middle-class families is excessive housing costs. Current data shows that 37% of middle-class households spend more than 30% of their gross income on housing, with many dedicating 40-50% to mortgage payments, property taxes, and maintenance.

This violates the fundamental 28% rule established by mortgage underwriters and financial planners over decades of analysis. When housing costs exceed 28% of gross income, families create a mathematical impossibility for wealth building.

The Mathematics of Housing Overconsumption

Consider a household earning $75,000 annually:

Recommended Housing Budget: $1,750/month (28% of gross income) Typical Middle-Class Reality: $2,500-3,000/month (40-48% of gross income) Annual Wealth Building Deficit: $9,000-15,000

Over a 30-year period, this difference compounds to approximately $675,000 in lost wealth accumulation opportunity, assuming a 7% annual investment return.

The Solution: Strategic Housing Optimization

Immediate Actions:

- Calculate your true housing cost percentage including maintenance, utilities, and property taxes

- If exceeding 28%, implement a three-year reduction plan through refinancing, downsizing, or geographic arbitrage

- Redirect excess housing costs to investment accounts immediately

Long-term Strategy:

- Purchase homes based on conservative income multiples (2.5x gross income maximum)

- Consider 15-year mortgages for faster equity building and interest savings

- Evaluate total cost of ownership, not just monthly payments

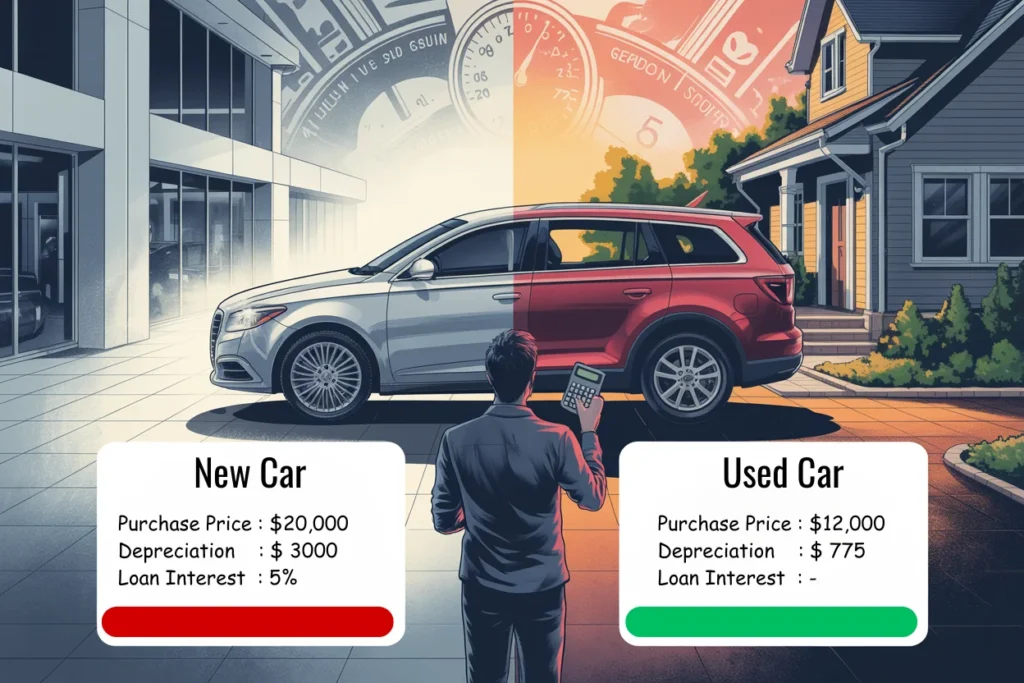

Mistake #2: The Car Payment Cycle – Perpetual Depreciation Debt

The Problem

Transportation represents the second-largest expense for most families, yet middle-class households consistently make wealth-destroying vehicle decisions. The average car payment has risen to $563 monthly, with many families carrying multiple vehicle loans simultaneously.

This creates what financial experts call “perpetual depreciation debt”—continuous payments on depreciating assets that provide no wealth-building benefit.

The Financial Impact Analysis

Typical Middle-Class Car Buying Pattern:

- New car purchase every 5-7 years

- Average payment: $563/month

- Trade-in while still owing money (negative equity)

- Lifetime car payments: $450,000-600,000

Wealth-Building Alternative:

- Purchase 2-3 year old vehicles with cash

- Drive for 8-10 years

- Invest car payment equivalent: $563/month

- 30-year investment value: $677,000

The difference between these approaches represents over $1 million in lifetime wealth impact.

The Solution: Transportation Cost Optimization

Immediate Implementation:

- Calculate total transportation costs as percentage of income (should not exceed 15%)

- If currently financing vehicles, accelerate payments to eliminate debt quickly

- Research reliable used vehicle options for next purchase

Strategic Framework:

- Purchase vehicles that are 2-3 years old to avoid steepest depreciation

- Focus on reliability ratings and total cost of ownership

- Maintain vehicles properly to extend useful life

- Never trade negative equity into new loans

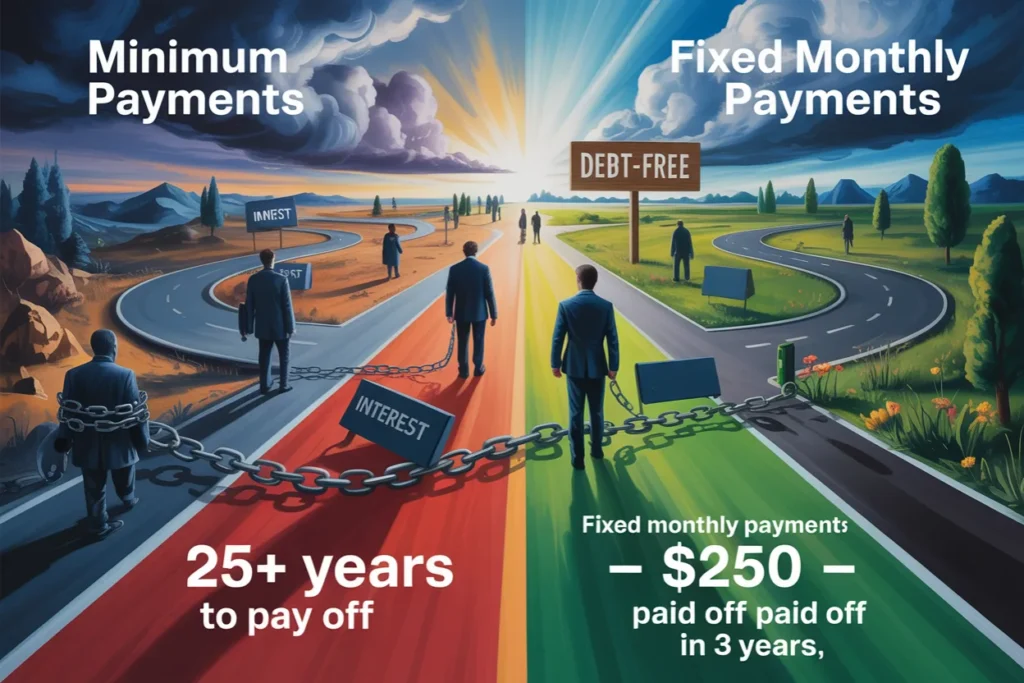

Mistake #3: The Credit Card Minimum Payment Trap

The Problem

Credit card debt represents one of the most insidious wealth destroyers facing middle-class families. Federal Reserve data shows the average middle-class household carries $6,194 in credit card debt, with many paying only minimum amounts monthly.

At typical credit card interest rates of 18-24% annually, minimum payments ensure decades of debt service while building no equity or wealth.

The Mathematics of Minimum Payments

Example: $6,194 credit card balance at 21% APR

- Minimum payment (3% of balance): $186 initially

- Time to payoff with minimum payments: 17 years, 8 months

- Total interest paid: $8,931

- Total cost: $15,125

Accelerated payoff strategy:

- Fixed payment of $300/month

- Time to payoff: 2 years, 2 months

- Total interest paid: $1,641

- Savings: $7,290

The Solution: Systematic Debt Elimination

The Debt Avalanche Method:

- List all debts with balances, minimum payments, and interest rates

- Pay minimums on all debts

- Apply additional payments to highest interest rate debt

- Upon payoff, redirect entire payment to next highest rate debt

- Continue until all consumer debt is eliminated

Implementation Timeline:

- Month 1: Complete debt inventory and establish payment strategy

- Months 2-24: Execute systematic elimination plan

- Month 25+: Redirect former debt payments to investment accounts

Mistake #4: The Emergency Fund Fallacy – Inadequate Financial Reserves

The Problem

Analysis shows that 63% of middle-class families cannot handle a $1,000 emergency without borrowing money. This fundamental lack of financial reserves forces families into debt cycles that prevent wealth accumulation.

The absence of adequate emergency funds creates what economists call “financial fragility”—vulnerability to economic shocks that destroy long-term financial progress.

The Proper Emergency Fund Structure

Traditional Recommendation: 3-6 months of expenses Enhanced Middle-Class Standard: 6-12 months of expenses

The higher standard reflects middle-class employment realities:

- Longer job search periods for professional positions

- Higher fixed costs that cannot be easily reduced

- Greater lifestyle maintenance requirements during unemployment

Mathematical Framework for Emergency Planning

Example: Household with $5,000 monthly expenses

- Minimum emergency fund: $30,000 (6 months)

- Optimal emergency fund: $60,000 (12 months)

- Recommended liquid investment vehicles: High-yield savings, money market accounts, short-term CDs

The Solution: Systematic Emergency Fund Building

Phase 1 (Months 1-3): Establish $2,500 starter emergency fund Phase 2 (Months 4-12): Build to 3 months of expenses Phase 3 (Months 13-24): Expand to 6-12 months based on income stability

Funding Strategies:

- Automatic transfers from checking to dedicated emergency account

- Tax refund allocation

- Bonus and overtime income dedication

- Temporary expense reduction during building phase

Mistake #5: The Retirement Contribution Gap – Systematic Under-Saving

The Problem

Middle-class families consistently under-contribute to retirement accounts, creating a mathematical impossibility for financial independence. Current data shows the median middle-class household has saved only $120,000 for retirement by age 55.

This under-saving occurs despite access to powerful wealth-building tools like 401(k) plans with employer matching—essentially free money that many families fail to capture fully.

The Retirement Savings Mathematics

Required Retirement Income: 70-80% of pre-retirement income Wealth Building Formula: Annual income × 10-12 by retirement age Example: $75,000 annual income requires $750,000-900,000 retirement savings

Current Middle-Class Reality vs. Requirement:

AgeRequired SavingsMedian ActualDeficit35$225,000$45,000$180,00045$450,000$78,000$372,00055$675,000$120,000$555,000

The Solution: Systematic Retirement Optimization

Immediate Actions:

- Maximize employer 401(k) matching immediately

- Increase contribution rate by 1% every six months until reaching 15-20% of income

- Open and fund IRA accounts for additional tax-advantaged savings

- Consider Roth conversions during lower-income years

Advanced Strategies:

- Backdoor Roth IRA conversions for high-income households

- Mega backdoor Roth for maximum contribution limits

- HSA maximization as supplemental retirement vehicle

- Tax-loss harvesting in taxable investment accounts

Mistake #6: The Insurance Coverage Gap – Inadequate Risk Management

The Problem

Middle-class families consistently under-insure against catastrophic risks while over-insuring against minor inconveniences. This inverted approach to risk management creates vulnerability to wealth-destroying events while wasting money on unnecessary coverage.

Common insurance mistakes include inadequate life and disability insurance while maintaining expensive extended warranties and low-deductible policies.

Proper Insurance Framework for Wealth Protection

Essential Coverage Requirements:

- Life Insurance: 10-12 times annual income for primary earners

- Disability Insurance: 60-70% of income replacement

- Umbrella Liability: $1-2 million minimum coverage

- Health Insurance: High-deductible with HSA optimization

Cost Optimization Strategies:

- Increase deductibles to $1,000-2,500 to reduce premiums

- Eliminate extended warranties and service contracts

- Bundle policies for multi-policy discounts

- Review coverage annually and adjust for life changes

The Solution: Strategic Insurance Restructuring

Phase 1: Audit current coverage and identify gaps Phase 2: Obtain quotes for essential coverage improvements Phase 3: Eliminate unnecessary policies and increase deductibles Phase 4: Invest premium savings in wealth-building accounts

Annual Savings Potential: $1,200-2,400 through strategic restructuring

Mistake #7: The Investment Procrastination Penalty – Delayed Wealth Building

The Problem

The most costly mistake middle-class families make is delaying investment in wealth-building assets. Time represents the most powerful factor in wealth accumulation due to compound interest, yet many households postpone investing until “perfect” conditions exist.

This procrastination creates what financial planners call “the compound interest penalty”—the exponential cost of delayed investment decisions.

The Mathematics of Investment Delay

Scenario: $500 monthly investment at 7% annual return

Start AgeInvestment PeriodTotal InvestedFinal Value2540 years$240,000$1,316,0003530 years$180,000$612,0004520 years$120,000$263,000

Cost of 10-Year Delay: $704,000 in lost wealth

The Solution: Immediate Investment Implementation

Systematic Investment Strategy:

- Establish automatic monthly transfers to investment accounts

- Implement low-cost index fund portfolio construction

- Maintain consistent contributions regardless of market conditions

- Rebalance annually to maintain target allocations

Recommended Asset Allocation Framework:

- Ages 25-35: 90% stocks, 10% bonds

- Ages 35-45: 80% stocks, 20% bonds

- Ages 45-55: 70% stocks, 30% bonds

- Ages 55-65: 60% stocks, 40% bonds

Investment Vehicle Priorities:

- 401(k) to employer match

- High-deductible health plan with HSA maximization

- Roth IRA contributions

- Additional 401(k) contributions

- Taxable investment accounts

Implementation Framework: Converting Knowledge to Action

The 90-Day Financial Recovery Plan

Days 1-30: Assessment and Stabilization

- Complete comprehensive financial audit

- Establish starter emergency fund ($2,500)

- Optimize insurance coverage and eliminate unnecessary policies

- Begin debt avalanche payment strategy

Days 31-60: Optimization and Acceleration

- Increase retirement contributions by 2-3%

- Implement systematic investment plan

- Refinance or optimize housing costs if necessary

- Establish automatic savings and investment transfers

Days 61-90: Advanced Strategy Implementation

- Complete emergency fund building plan

- Optimize tax-advantaged account contributions

- Implement tax-loss harvesting strategies

- Establish annual financial review schedule

Measuring Progress: Key Performance Indicators

Monthly Metrics:

- Housing costs as percentage of gross income (target: <28%)

- Total debt payments as percentage of income (target: <20%)

- Savings rate including retirement contributions (target: 20%+)

Annual Assessments:

- Net worth growth rate (target: 10-15% annually)

- Emergency fund adequacy (target: 6-12 months expenses)

- Investment returns vs. benchmarks

- Insurance coverage adequacy review

The Long-Term Wealth Building Impact

Projected Outcomes: Implementing All Seven Solutions

Family Profile: $75,000 annual income, ages 35-65 (30-year timeline)

Current Path (Making All 7 Mistakes):

- Net worth at retirement: $285,000

- Retirement income replacement: 35% of pre-retirement income

Optimized Path (Implementing All Solutions):

- Net worth at retirement: $1,847,000

- Retirement income replacement: 85% of pre-retirement income

- Wealth Difference: $1,562,000

This analysis demonstrates that middle-class financial success depends not on extraordinary investment returns or high incomes, but on systematic avoidance of common mistakes and consistent implementation of proven wealth-building principles.

Conclusion: The Path Forward

The financial mistakes that keep middle-class families broke are neither mysterious nor insurmountable. They represent systematic violations of established financial principles that have guided successful wealth building for generations.

As Warren Buffett has consistently emphasized, building wealth requires neither genius nor luck, but rather the discipline to avoid common mistakes and implement proven strategies consistently over time.

The seven mistakes outlined in this analysis—excessive housing costs, perpetual car payments, credit card debt, inadequate emergency funds, insufficient retirement savings, improper insurance coverage, and investment procrastination—can be corrected through systematic application of the solutions provided.

The choice facing every middle-class family is clear: continue making these costly mistakes and remain financially vulnerable, or implement the corrective strategies and build substantial long-term wealth.

Your financial future depends not on market timing, economic conditions, or government policies, but on the decisions you make today regarding these fundamental wealth-building principles.

The time for action is now. Begin implementing these solutions immediately, and let the mathematical certainty of compound interest work in your favor rather than against you.

Remember: The best time to correct financial mistakes was yesterday. The second-best time is today. Choose wisely, implement systematically, and build the financial security your family deserves.